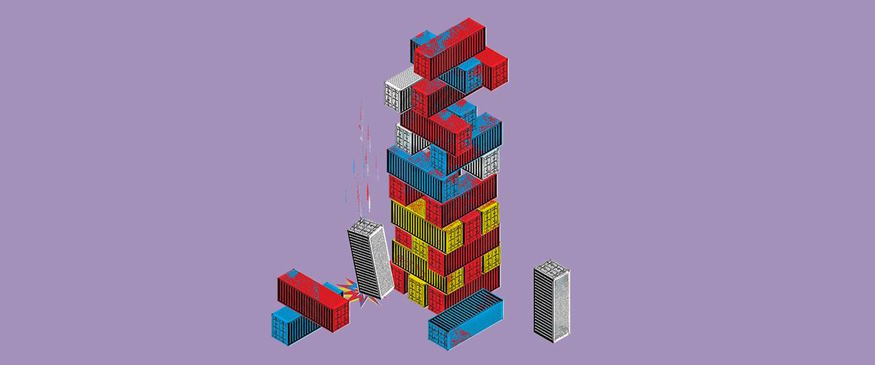

Trade wars and tariffs have become prominent features of the global economic landscape in recent years, with profound implications for countries’ export revenue. As nations engage in escalating trade disputes and impose tariffs on imported goods, the consequences reverberate through economies worldwide. Export revenue serves as a crucial driver of economic growth and prosperity, making it imperative to analyze the impact of trade wars and tariffs on countries’ ability to generate income from international trade. Furthermore, we discuss strategies that countries can adopt to mitigate the adverse effects of trade wars and tariffs and highlight the importance of diplomatic solutions for fostering stable and prosperous international trade.

The impact of trade wars on countries’ export revenue

The impact of trade wars on countries’ export revenue is multifaceted, encompassing various dimensions that hinder economic growth and prosperity. One of the primary consequences is the decreased market access and export opportunities that arise from trade disputes and the imposition of tariffs. When countries engage in trade wars, they often resort to protectionist measures, such as imposing higher tariffs or introducing non-tariff barriers. These actions restrict market access for exporters and create barriers to entry in foreign markets. As a result, businesses face limited opportunities to sell their products abroad, leading to a decline in export revenue.

Furthermore, trade wars contribute to a decline in export volumes and values. Higher tariffs imposed on imported goods make them more expensive for consumers in the target country, reducing the demand for those products. Consequently, exporters witness a decline in sales and export volumes, impacting their revenue streams. The decline in export values is also a significant concern. Tariffs can lead to a decrease in the price competitiveness of goods in the target market, forcing exporters to either absorb the additional costs or pass them on to consumers. Either way, it affects the overall revenue generated from exports.

In addition to market access and export volume decline, trade wars disrupt global supply chains. Modern economies heavily rely on complex and interconnected supply chains that span across countries. The imposition of tariffs disrupts these supply chains by increasing costs, introducing uncertainties, and creating bottlenecks in the movement of goods and services. As a result, exporters face logistical challenges, delays, and increased costs associated with rerouting supply chains or finding alternative sourcing options. These disruptions further contribute to a reduction in export revenue for countries involved in trade wars.

European Union-United States trade disputes

The trade disputes between the European Union (EU) and the United States have had far-reaching consequences, significantly impacting export revenue for both parties involved. Let’s explore the key aspects of these disputes and their effects.

Firstly, the EU-US trade disputes have had a notable impact on export revenue for both regions. The imposition of tariffs on various goods, ranging from steel and aluminum to agricultural products and automobiles, has led to reduced export opportunities. As a result, businesses in the EU and the US face barriers in accessing each other’s markets, leading to a decline in export volumes and revenue.

Tariff escalation and retaliatory measures have further exacerbated the trade disputes. The EU and the US have engaged in a tit-for-tat approach, escalating tariffs as a means of retaliation. This back-and-forth escalation has created an environment of uncertainty, making it challenging for businesses to plan and invest in cross-border trade. The resulting trade barriers, increased costs, and market disruptions have negatively impacted export revenue for both parties, as well as causing ripple effects throughout global supply chains.

Moreover, retaliatory measures have had a particularly damaging impact on certain sectors. For instance, the EU’s retaliatory tariffs on US agricultural products have significantly affected American farmers and exporters. Conversely, US tariffs on EU automobile imports have hit European automakers and related industries hard. These targeted measures have disrupted established export channels, causing revenue losses and potential long-term damage to businesses in these sectors.

Other trade wars and their implications

Trade wars are not exclusive to specific regions or major global powers. They can erupt between countries across different corners of the world, each with its unique factors and consequences. Let’s examine a few examples of trade wars and their implications in different regions.

One notable example is the trade war between India and Pakistan. The long-standing political tensions between these neighboring countries have spilled over into the economic realm. Both nations have imposed tariffs and trade restrictions on each other, leading to a decline in bilateral trade and export revenue. The repercussions of this trade war are particularly felt in industries such as agriculture, textiles, and manufacturing, which heavily rely on cross-border trade.

Another significant trade war unfolded between Australia and China. This dispute emerged from political disagreements and diverging strategic interests. China, as Australia’s largest trading partner, imposed trade restrictions and tariffs on Australian goods, such as coal, barley, and wine. These measures have had a severe impact on Australian exporters, resulting in decreased export revenue and market access. The trade war also highlighted the vulnerability of countries heavily reliant on a single export market and the need for diversification.

Unique factors and consequences shape each trade war. Factors such as geopolitical tensions, economic disparities, and competing interests influence the nature and intensity of these conflicts. The consequences can range from reduced export volumes and revenue to the disruption of supply chains, job losses, and a broader economic downturn.